FINANCIAL TIMES - COP26: oil price soars even as the world turns against fossil fuel

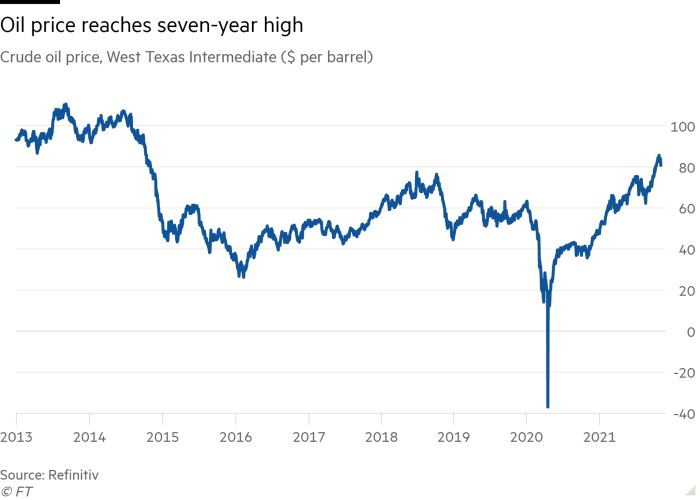

Post-pandemic demand and insufficient supply have driven oil prices to a seven-year high amid calls for the sector to boost short-term output, but that would infuriate climate activists and even more investors.

(By Derek Brower)

Summary of the article:

When Joe Biden spoke during last year’s presidential election about leading the US in a «transition from oil», he hardly expected to be asking the world’s crude producers for more supply just 12 months later.

But the US president’s administration has made repeated efforts to drive down oil prices in recent weeks. First came a trip to Riyadh for Jake Sullivan, Biden’s national security adviser, where he asked Saudi Arabia to increase production. Then Jennifer Granholm, Biden’s energy secretary, told the Financial Times in October that the US was considering a price-sapping release of crude from its strategic stockpiles. The White House even contacted some US oil producers to ask how quickly they could bump up output — an awkward move for an administration that many oil executives consider hostile to their sector.

On the eve of the Glasgow climate summit, COP26, that began on Sunday, Biden even floated the prospect of retaliation against Russia and Saudi Arabia if they didn’t increase oil output soon.

Pump politics

A year away from midterm elections, the danger of further oil price inflation for Biden is plain. A gallon of petrol in the US now costs on average $3.40, according to the AAA motoring group — half the price a consumer in the UK might pay, but 60 per cent more than during the final months of the presidency of Donald Trump. Stickers of a pointing Biden, declaring, «I did that», are available on Amazon.com and have, in recent weeks, begun appearing next to the price ticker on forecourt pumps.

Biden’s Republican opponents have seized on rising petrol prices to argue that his energy policies are penalising Americans already squeezed by supply chain chaos. The president’s restrictions on new federal drilling licences and cancellation of the Keystone XL oil pipeline — one of his first acts in office — have brought an inevitable reckoning, they say.

The pandemic’s silver lining fades

As the air quality in cities improved last year, a seductive notion emerged: that pandemic lockdowns had helped cure the world of its oil addiction. Governments could now «build back better», accelerating a clean green pivot to the lower-carbon economy and making strides in the effort to halt climate change.

The notion, at least in terms of demand, has proved shortlived. Stimulus spending and months of cheap oil prices sparked a revival in consumption at a pace almost as stunning as the drop had been during the pandemic collapse. Between the second quarters of 2020 and 2021, global oil consumption rose by 12m b/d, according to the IEA, an unprecedented surge.

BP now estimates that global consumption is already back to 100m b/d, close to 2019 levels. More consumption growth lies in wait, argue other analysts, as supply chain bottlenecks are loosened and jet fuel demand picks up once travel begins again in earnest.

Shale could come up short

The bigger market distortion is in supply — and nowhere is that more visible than in the US. On the surface, things suddenly look rosy. Oil company coffers are bursting with cash again. Last week, less than 24 hours after Darren Woods, ExxonMobil’s chief executive, and his Chevron counterpart Michael Wirth appeared in Congress for a grilling about climate disinformation, their companies reported bumper quarterly profits and juicy share buybacks.

Exxon, defeated by the activist hedge fund Engine No 1 in a bitter shareholder proxy battle earlier this year, even raised its dividend for the first time since before the pandemic. Shale companies are in similarly rude financial health.

Pressure to ‘not invest’

The rest of the world may not have much new oil to yield either. From a peak of almost $1tn in upstream capital spending in 2014, the total had fallen to less than $400bn by 2020 and is forecast to remain below $500bn between now and 2025, according to Wood Mackenzie, a consultancy. And even though development costs have also fallen — reducing the amount of spending needed — the direction of travel is obvious.

«We’re in an environment now where there’s a lot of pressure on oil companies to not invest,» says Murti. «That pressure comes from investors. It comes from environmental and climate activists. It comes from government officials».

Opinion comment on the article:

Firstly, it seems to be a huge discrepancy between most of the media on one side and the reality on the other. The article title is "oil price soars even as the world turns against fossil fuel" but the entire article tells how the world actually does and will not turn against oil. People (including most journalists these days) spend most of their times with being scared from the catastrophic made-up climate doom scenarios and fearing the extinction of human race, but they don't spend enough time to understand what their living standard and the entire humanity is built on: hydrocarbons.

From my point of view, limiting oil and gas production and manipulating their price is a ridiculous, crude and ineffective way of reducing emissions. Instead, the only positive way forward is to develop, make readily available and facilitate the use of alternate energy sources. Then the need and use of fossil fuels to meet a growing energy need will diminish of its own accord.

However, not that oil and gas use will ever, or need ever, be eliminated. They will remain vital source materials for numerous products: medicines for example. Moreover, the idea that we are going to get rid of oil is just "nonsense". It is realistic to believe that we can decrease our dependence on coal by replacing much of it with a combo of wind energy + natural gas. But eliminating oil isn't even on the horizon.

In conclusion, I suppose no one planned for the energy transition. We have to take into account that climate is too complex a problem to leave to politicians. Maybe, we should consider putting technocrats in-charge. Furthermore, we see lots of talk but I have never seen any conclusive plan considering all the effects on the environment of a move to EV. It seems to me there is an attitude of trial by error. I am guessing it will not be long before a light goes on and there is a realisation a clear plan is needed rather than just "bungling on".